InsideEdge Trader powered by Rithmic Data Technology is a powerful execution platform. Day traders to professional money managers will benefit from its adaptable tools including chart based trading, advanced volume analysis, and programmable execution strategies. Server co-location is available for InsideEdge Trader users.

InsideEdge Trader | Rithmic

InsideEdge Trader Monthly Fee

- Standard – $59

- Automation – $109

- Professional – $159

Innovative Order Entry

Trading through the charts is the easiest order entry method with Inside Edge Trader. Trade by clicking on the price bars or candles to enter and manage trades.

Multiple Depth of Market (DOM) windows allow the user to track the markets, orders, and positions through their choice, the Simple DOM, Scalping DOM, or Multi (3x) DOM.

Advanced Order Strategies

Advanced Order Strategies provides an easy interface to build advanced combinations of intelligent orders such as bracket orders, trailing stops, indicator trailing stops, average price and net position tracking.

Configure a combination of intelligent orders to create the desired behavior for entering or exiting a trade. Each order can be setup to automatically modify its price or volume depending on external conditions. Pre and Post conditions defines what should happen prior to or after an order completes (filled or canceled).

Automated strategies built in third party software such as TradeStation or eSignal can be configured to take advantage of the speed of Rithmic on InsideEdge Trader.

Strategy Development and Account Management

Using the principles of state-event machines, time sequenced strategies can be built that allows step by step condition evaluation prior to triggering a trade. No programming skills are required since the strategy is created using built in dialogs and menus.

The account manager provides a summary view of the existing accounts including both simulated and live, information on markets that have been traded on each account, as well as the last recorded position. Run fill reports on each account for advanced performance statistics and analysis.

Replay tick by tick market data in real time or speed up the replay to practice trading during off hours to backtest developed strategies.

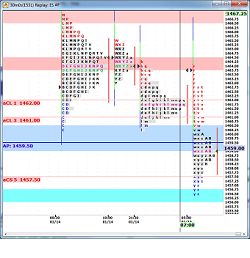

Market Profile

One of the few platforms developed for Market Profile traders, Inside Edge allows you to gain and understanding of markets that was previously reserved for exchange members only. By combining time, price, and volume in one display, you are enabled to analyze and reveal pricing patterns from any market as they develop.

Order flow analytics delivers volume study indicators with trade size filtering such as cumulative delta, split volume and Buy/Sell differentials. Use long term Volume Profiling histograms with trade size filtering to help identify market structure. Learn when institutions are coming into the market using the institutional volume filter to track the bid/ask activity at any point in time.